Insurance May Have You Covered, but It Might Not Be Worth It

May 16, 2016

By Paul Sullivan

If you have something to insure, there is probably coverage for it.

Endorsements, as additions to insurance policies are called, can cover specific items, like jewelry or wine, or specific events, like floods and earthquakes.

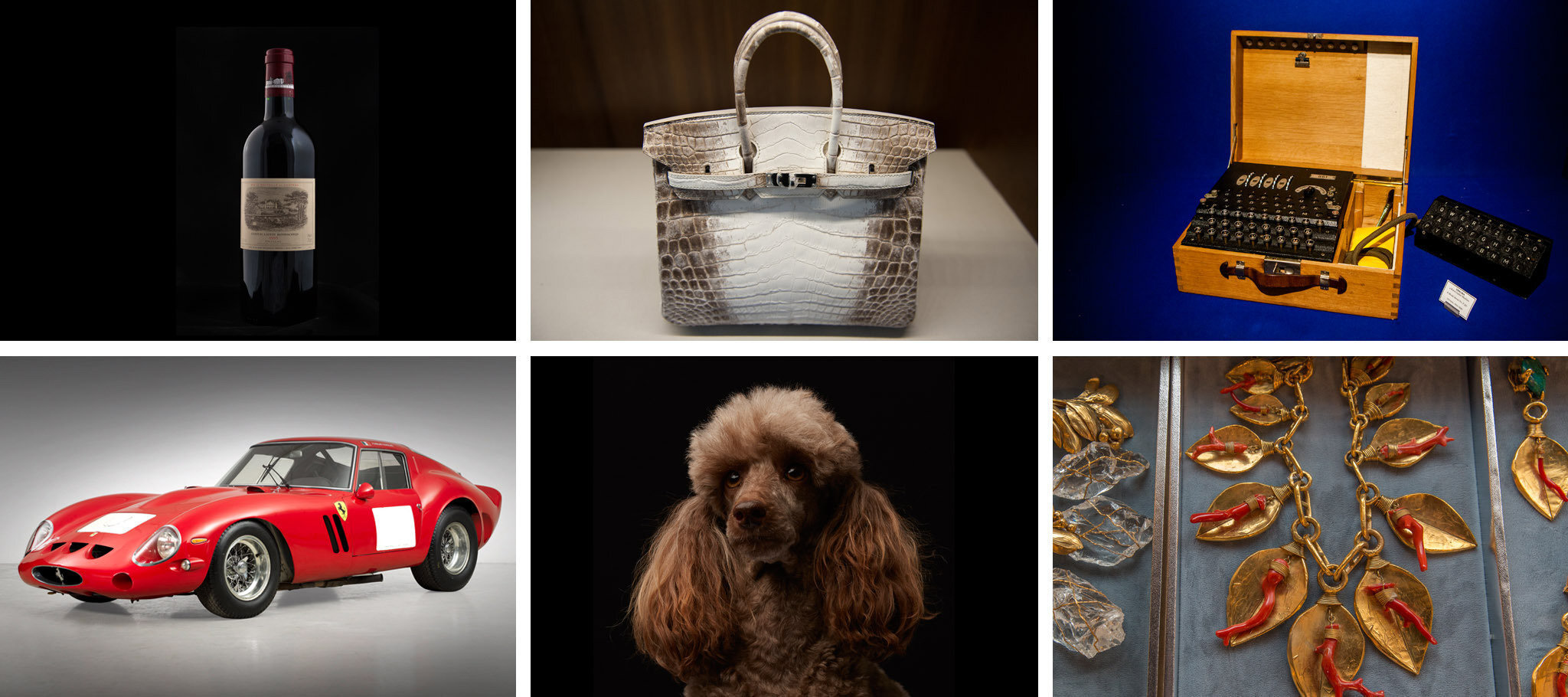

But what about pets injured in a car crash? Or a collection of Hermès Birkin bags, which start at about $12,000 apiece and go up from there? Or dealing with the psychological consequences of online bullying? There are endorsements for that, too.

Some of this coverage is surely necessary. Expensive earrings get lost. Water damage is costly to clean up. But other coverage offered by insurers, particularly those that cater to the affluent, may represent a niche market at best.

At worst, it is the equivalent of buying an extended warranty on a new flat-screen television: Chances are you’re never going to use it.

The coverage, insurance experts said, may be too expensive for the risk, or it may seem to be affordable but provide little additional coverage.

“It’s a buyer-beware situation,” Patti Clement, senior vice president for high-net-worth private client services at HUB International Northeast, said of the various endorsements. “It’s not about price. It’s about risk. People have to understand that first.”

Insurers that cater to the affluent, like the American International Group, Chubb and PURE, along with the private client groups at mainstream insurers like Nationwide, regularly introduce new types of coverage to add to their property, automobile and excess liability policies.

Here is a look at an array of endorsements, rated by how broadly applicable they are likely to be.

Extras You May Need

Most homeowners’ policies offer little coverage for personal property, like watches and rings, let alone collections of wine, cars or art. If they do, the limits are low, which is where endorsements come in.

There are generally two ways to cover those items — through a blanket endorsement that insures a dollar amount of, say, jewelry or wine, or by scheduling the items individually.

Most industry experts suggest a combination of the two. “What I recommend is you take your most expensive items — your top jewelry, your most expensive art, your most expensive bottles of wine — and put those on a schedule,” said Janet Ruiz, the California representative for the Insurance Information Institute. “The rest of them you’d put on a blanket policy for, say, $50,000. Any item that gets lost, stolen, broken, you’ll get it covered up to that limit.”

But the value of those items must be periodically reappraised. The price of rebuilding a house in the case of a total loss is easy to determine. But the value of someone’s diamond ring or vintage Ferrari is a different matter. It is going to appreciate or depreciate based on a mix of market forces and demand for a particular object.

“We try to make it as simple as possible by locking in what we’ll pay,” said Jim Fiske, North American marketing manager at Chubb Personal Risk Services. “If you haven’t kept up in the value, we give you an extra 50 percent.”

In many cases, that’s fine. But as Mr. Fiske pointed out, his wife’s engagement diamond is probably worth two to three times what he paid for it 25 years ago.

But you could also be paying for items you no longer have or paying a higher rate for the coverage than you would be paying if you had obtained new quotes.

Mark Galante, chief marketing officer of Pure Insurance, said most people would be well served to insure any risk associated with water, from floods to mold. He said the damage caused by a backed-up sewer drain could cost as much as $100,000.

“That’s a real issue for people,” he said. “You want to make sure you have comprehensive coverage. You also want to check where your carrier has been tightening coverage.”

Flood coverage is something separate. Insurance can be bought through the National Flood Insurance Program with coverage of up to $250,000 for a home and $100,000 for its contents. But through specialty carriers, homeowners can increase coverage on their houses and property

Unlikely Events, Big Payouts

Excess liability policies, or umbrella policies, are used in conjunction with homeowners’ and automobile policies. They kick in at levels above the liability in more general policies and pay out when someone is sued.

Of course, people are not sued every day. But when they are, the wording of the endorsement will determine what is covered.

“Liability insurance covers claims against you in the event of a bodily injury — you hurt somebody physically — or libel or slander, or you damage someone’s property,” said Jonathan Crystal, executive vice president of Crystal & Company, an insurance broker. “It could come while you’re driving, or from your personal activities if you’re entertaining.”

The pricing depends on the person, Mr. Crystal said. The more prominent a person is and the more assets that person has, the higher the price.

His firm developed a website, whatsmyliability.com, to help people begin making that assessment.

Earthquake coverage is for another event that is unlikely but potentially costly. “It’s going to provide significant coverage in a catastrophic event,” said Mr. Galante at Pure. “The problem is, there is a meaningful deductible attached to it.”

Through Pure, he said, the deductible could be 5 to 25 percent of a dwelling’s value.

Fraud or identity theft coverage can be valuable. It pays claims to cover the costs of helping people recover their identity. A.I.G. Private Client offers an endorsement that pays up to $250,000.

This Is Just for You

If you are thinking of taking your yacht to Rio de Janeiro for the Summer Olympics, your yachting insurance may not cover it. Most insurance is limited to certain navigable waters, like the Eastern Seaboard and the Caribbean.

In response to requests from clients, Jeremiah Hourihan, president of A.I.G.’s private client group, said the company created endorsements for existing clients to take their yachts to Rio. The cost is about 10 percent above the existing premium for a yacht based in Florida.

The company did the same for liability involving horses. “Standard homeowners’ doesn’t protect you if you’ve got horses on your property,” Mr. Hourihan said. “Or if the polo pony gets out of control at the polo ground and injures a third party.”

The cost for that starts at $250 a year for $1 million of coverage.

In the case of the Birkin bags, an art adviser working for A.I.G. noticed them while appraising a client’s art that was already covered.

That sort of coverage has a niche clientele. A broader niche is coverage for people who work out of their homes. Ms. Ruiz of the Insurance Information Institute noted that her husband had a business repairing guitars at home. Their homeowners’ policy did not cover a home business, so they bought an endorsement.

Probably Redundant

Insurance for so-called lifestyle-related risks has been popular. Whether it is worthwhile is hard to say. In some cases, it may be redundant or unlikely to be used.

Online bullying insurance falls into this category. Chubb added it this year to its family protection coverage, which also insures against carjacking, hijacking, child abduction, stalking, home invasion and air or road rage.

But despite the name, it does not provide coverage if your child is the bully, which would most likely need to be covered under an excess liability policy written to include bodily and personal injury.

Online bullying insurance covers the related medical and psychological expenses from an incident up to $60,000. Mr. Galante, speaking as one of Chubb’s competitors, said most of those expenses would already be covered by health insurance.

“Only one in 10 teens tells a parent if they’ve been a cyberbully victim,” he said. “We need to do more to create conversations around these incidents than creating products that aren’t necessarily going to help people reclaim their lives.”

While it’s not expensive — $110 yearly for the whole package — it may be a waste for an individual but a boon for an insurer, which can collect premiums from thousands of people with little likelihood of paying a claim.

“Cyberbullying or cybersecurity or enhanced fraud protection or travel insurance — they’re all good things to have,” Mr. Crystal said. “But they’re part of a broader effort for insurance companies to differentiate themselves. That’s going to go against what clients need, which is something tailored to them.”

Whatever endorsements people buy, it’s good that they at least know what they are and are not covered for. “People,” Ms. Ruiz said, “think more is covered under their homeowners’ policy than actually is.”