The Strength of PURE's Model

When Benjamin Franklin created the first U.S.-based insurance company centuries ago, it centered on the idea of community: that neighbors—people who share similar values with one another—could pool their risks and take care of each other. Somewhere along the way, the insurance industry lost this focus.

At PURE, our compass points away from today’s shareholder-focused insurance model (and the feelings of distrust it sometimes inspires) and instead leads us toward our members—a community of smart, responsible individuals protecting the good of the group—and toward a return to Franklin’s original vision. The key to this intention is our reciprocal model.

What exactly is a reciprocal insurer?

There are a number of ways to structure an insurance company. The most commonly known are the stock and mutual models. The reciprocal model is simply another structure; and while it is lesser known, over the last decade, it has become a go-to model for new insurance companies. Its popularity has all to do with the power of this model and the alignment it creates.

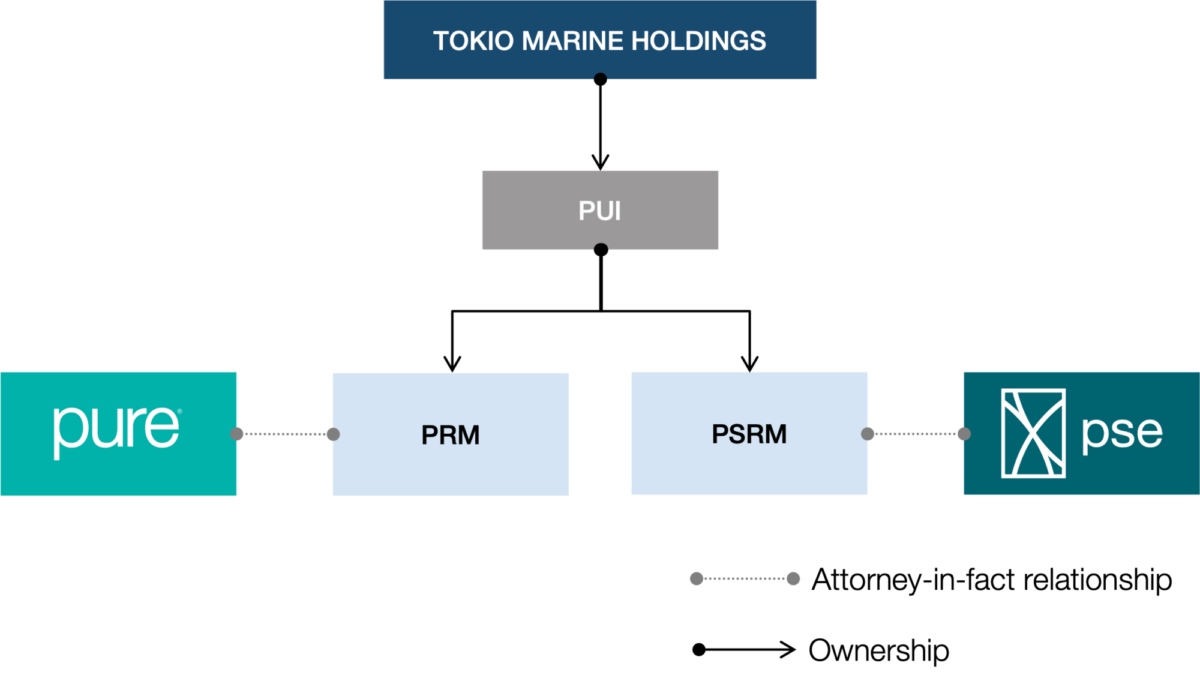

With this structure, the insurance company is owned by its policyholders, also known as members, and managed by another company: a third party known as an attorney-in-fact. The attorney-in-fact runs the company’s day-to-day operations like issuing policies and handling claims. PURE is owned by our members and managed by the attorney-in-fact, PURE Risk Management (PRM).

But this isn’t a new concept. It’s as old as insurance itself. And, because the entities involved aren’t trying to profit off each other, the reciprocal model often results in increased savings for members.

PURE’s take on it

PURE’s reciprocal model is designed to focus on the membership, and this incentivizes us to charge a fair price, pay what is owed after a claim and deliver excellent service to members.

Instead of collecting premiums to increase profits or please outside shareholders, we invest in our members’ homes to make them more resilient and explore new technologies meant to make their lives easier. In short, our structure keeps the membership our top priority when it comes to how their premium dollars are spent.

Privilege Underwriters Reciprocal Exchange (PURE)

PURE is a reciprocal insurer that is owned by the membership and designed for the most responsible owners of the finest-built homes. With members at the core of our model, we are incentivized to do what’s right for them by providing excellent service, investing in ways to make their homes more resilient, paying what is owed after a claim and charging a fair price.

PURE Specialty Exchange (PSE)

PURE Specialty Exchange is a specialty non-admitted insurance carrier dedicated to providing coverage for responsible high net worth families with homes that do not meet the admitted market's preferred appetite. PSE is a reciprocal exchange (like PURE), which means members agree to pool their risk. Coverage from PSE is made available through PURE Programs.

Tokio Marine Holdings, Inc. (Tokio Marine)

PUI, our holding company, is a part of the Tokio Marine Group, one of the largest and most respected insurers in the world. Being part of the Tokio Marine Group supports our financial stability and claims paying ability by providing access to explicit capital support.

Privilege Underwriters, Inc. (PUI)

PUI employs the 1,000+ exceptional people who come to work each day dedicated to serving our members and policyholders. It is the workplace culture within PUI that makes it possible for us to attract top talent and deliver an exceptional service offering.

PURE Risk Management, LLC (PRM) & PURE Specialty Risk Management, LLC (PSRM)

PRM and PSRM serve as the Attorney-In-Fact for PURE and PURE Specialty Exchange, respectively. Through an Attorney-in-Fact Agreement between these entities, PRM and PSRM agree to provide marketing, underwriting, claims administration and other services to ensure a seamless member experience.

How it benefits members

There are many ways in which members benefit from the reciprocal structure, from unique tools designed to make members more informed and safe to money back for our most loyal members. One of the most tangible benefits of membership comes in the form of Subscriber Savings Accounts—accounts held in members’ names to which the company makes yearly allocations dependent on performance and underwriting results.

With members at the core of the model, policyholders regain the power to protect their assets and trust that their insurance works for them. Ultimately, PURE would not exist without our membership, and to prove their value, we designed our company’s whole model around them.

Glossary of Terms

Reciprocal Exchange

An insurance model that puts members first

An unincorporated association in which members (as individuals, partnerships, trustees, or corporations) exchange contracts and pay premiums through an attorney-in-fact for the insurance of each other.

Attorney-in-Fact

Third party who runs day-to-day operations

A person or entity who is authorized to act on behalf of another person or entity, usually to perform business or other official transactions. PURE Risk Management serves as PURE’s attorney-in-fact.

Subscriber Savings Accounts

A tangible benefit of membership

As part of PURE's unique membership model, PURE may allocate a portion of its total capital to members through individual accounts held in their name, also known as Subscriber Savings Accounts.