Earthquakes in the Northeast: How Worried Should I Be?

Jason Simoni

Head of Product

April 12, 2024

Just two days after a powerful, 7.4 magnitude earthquake struck Taiwan, to the surprise of many, the New York metropolitan area experienced its own seismic activity as a light, 4.8 magnitude earthquake struck New Jersey. The quake was felt from Philadelphia to Boston.

While the effects of the Northeast quake pale in comparison to the effects of the quake in Taiwan (and that's likely an understatement) its occurrence has many questioning the likelihood of a major earthquake in the New York area and elsewhere in the country. And that observation has us at PURE questioning the true risk of earthquakes in the U.S.

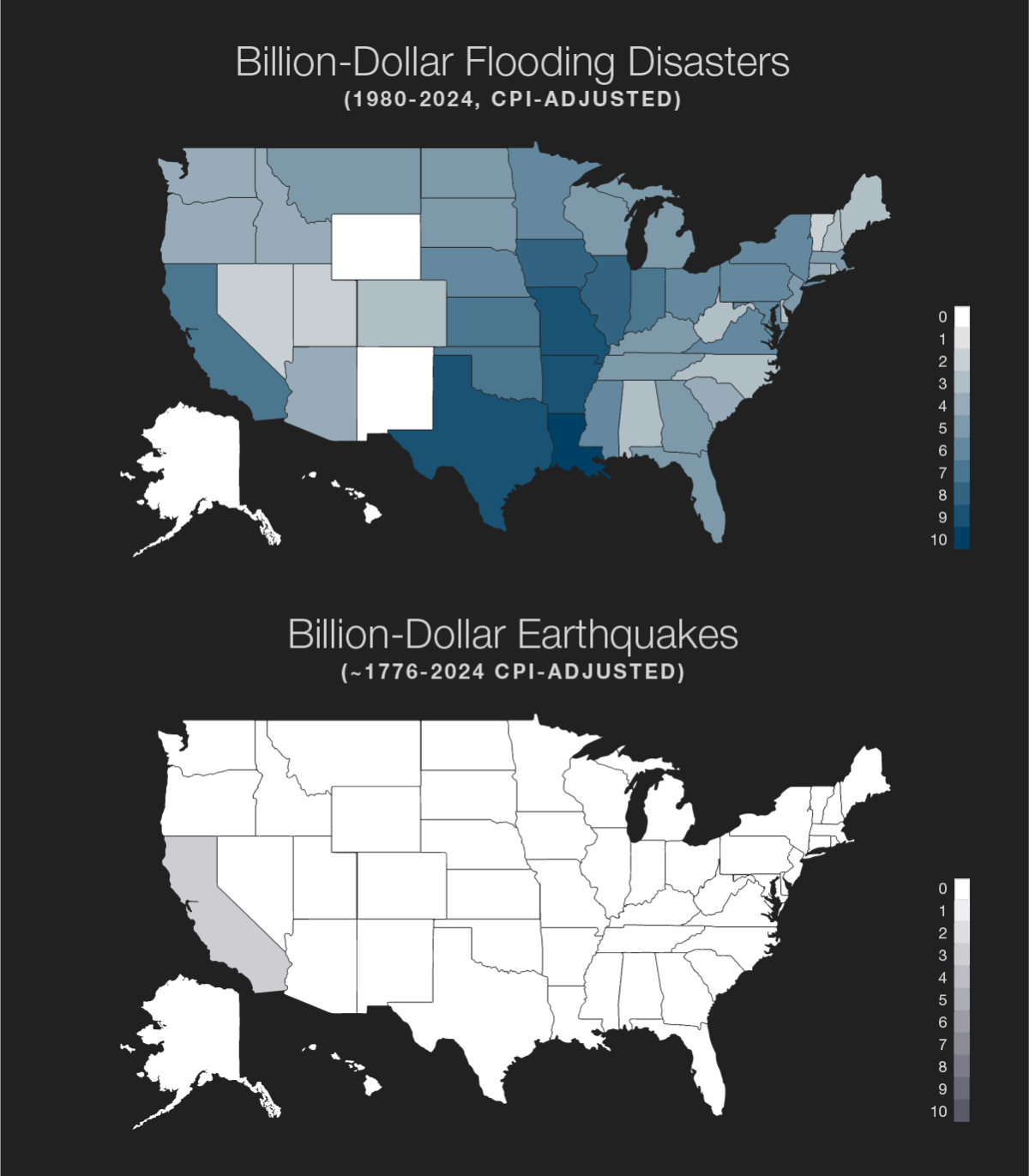

It is undeniable that major earthquakes can be devastating—but they are also very rare. In fact, there have been only three major earthquakes ever recorded in the U.S. where damage exceeded $1 billion in inflation adjusted* damage: San Francisco 1906, Loma Prieta 1989 and Northridge 1994. Meanwhile, there were four separate floods in the U.S. in 2023 alone that caused $1 billion in damage, and a total of 44 since the Federal Emergency Management Agency (FEMA) began tracking in 1980.

Let’s now consider severity. The 10 most costly earthquakes in U.S. history totaled $44.9 billion in damage. In comparison, the 1993 Texas flood, on its own, caused $45.3 billion in damage.

While earthquake risk is generally limited to the areas that follow fault lines, flood risk is more widespread with almost every single state impacted by a catastrophic flood in recent decades—only Wyoming, New Mexico, Alaska and Hawaii have been spared from a billion dollar plus event. This reality seems disconnected from what many perceive to be their risk of flood, proved by the low take-up rate for Flood Insurance.

One factor driving the misalignment is outdated flood maps. FEMA maintains nationwide maps, officially known as Flood Insurance Rate Maps, that are supposed to indicate the risk of flooding to an area. But these maps are based on previous flood events and don't account for rising sea levels, heavier rainfalls or riverine flooding, and they can be hampered by outdated data and models. They can also create a false sense of security by focusing on whether a property is inside or outside of a floodplain, without addressing risk to individual properties. FEMA has reported that 1 in 4 NFIP claims filed are by homeowners outside of what their maps suggest are high-risk areas.

First Street Foundation, a nonprofit research company focused on connecting climate change and financial risk, has identified that 14.6 million U.S. properties have a substantial risk of flooding— which is nearly 68% more properties than what FEMA designates as high-risk.

Everyone should consider purchasing Flood Insurance

As a reminder, Flood is not covered by a traditional Homeowners policy, so the purchase of specific flood coverage, like that offered by the National Flood Insurance Program (NFIP), is required. And in many cases, especially for PURE members and other high net worth families, Excess Flood coverage or a special broadening endorsement (or both) will also be needed to help ensure adequate coverage.

Flood coverage is one of the most important coverages a homeowner can purchase, and nearly every property has some risk of flooding.– Martin Leitch, Chief Executive Officer

And as for earthquakes in the Northeast? Small earthquakes, with an emphasis on "small," are actually fairly common in the Northeast. Damage doesn’t generally occur with events under magnitude 6, and there have been only five quakes above that scale to impact the region in the last 400 years. The largest to impact New York City to date was a magnitude 5 quake in 1884. I view the threat of weather-driven perils to be of far greater concern for the region.

Talk to your broker about your risk tolerance should an earthquake happen in your area and remember, like flood, earthquake is not covered by most Homeowners policies.

*Dollars throughout are adjusted for inflation.

This material is descriptive only. The precise coverage offered is subject to the terms and conditions of the policies issued.